Employers Struggling with The Affordable Care Act

For companies with 50 or more employees, their penalty for not having minimal essential coverage in place:

Overview

Employers must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to age 26, or be subject to penalties. This is known as the employer mandate. It applies to employers with 50* or more full-time employees, and/or full-time equivalents (FTE). Employees who work 30 or more hours per week are considered full-time.

The employer mandate and employer penalties

Employers subject to the employer mandate are required to offer coverage that provides “minimum value” and is “affordable,” or be subject to penalties. The chart below explains these requirements and the penalties that apply if they are not met.

Examples of employer penalties

The employer does not offer coverage to full-time employees.

The penalty is $2,160 per full-time employee, excluding the first 30 employees. This example shows how the penalty would be calculated.

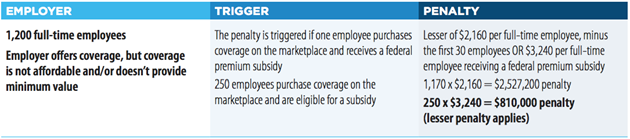

The employer offers coverage that does not meet the minimum value and affordability requirements.

The penalty is lesser of the two results, as shown in this example:

Determining how many full-time employees you have

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

Full-time employees work an average of 30 hours per week or 130 hours per calendar month, including vacation and paid leaves of absence.

Part-time employees’ hours are used to determine the number of full-time equivalent employees for purposes of determining whether the employer mandate applies.

FTE employees are determined by taking the number of hours worked in a month by part-time employees, or those working fewer than 30 hours per week, and dividing by 120

The ACA Employer Solution

MEC Plans with Limited Benefits and Healthcare Concierge Services

The MEC plan + is the lowest cost and easiest to manage solution in the marketplace. Our team of Brokers and Compliance experts have partnered with the top carriers in the industry to provide solutions to business in the US who are struggling to find an affordable solution to the UN-Affordable Care Act (ACA).

It is a strategy that is compiled of a one of a MEC plan, composite rated indemnity plans, and major medical plans. We help protect instead of penalize businesses. That means protect businesses and their employees families by providing insurance plans at an affordable rate while ensuring compliance with the ACA. We also include telemedicine, coverage, a discount RX card, accident and critical illness coverage

Minimum Essential Coverage plans include:

General Information (Preventive Care Only)

$0 Co-pays

(except for contraceptives)$0 Deductible

Benefit ercentage

100% of covered expenses paid by the plan

Unlimited Plan Annual Maximum

Unlimited Plan Lifetime Maximum

Summary of Covered Services

Below are a few of the common covered preventive health services the plan covers. The plan may also cover a service that is not listed, as long as the service is a covered preventive health service as described in the policy.

Covered Services for Children & Adolescents

Well Child Exams – physical exams & vision acuity

Assessments – developmental & behavioral

Immunizations – diphtheria, tetanus and pertussis

Screenings – hearing loss, lead poisoning and depression

Covered Services for Adults

Annual Preventive Care Visits – physicals & history

Immunizations – hepatitis & influenza

General Health Screenings – blood pressure,

cholesterol & diabetesPrescription contraceptives for women